AMD posts strong $1.93 billion in revenue for Q2 2020 as it gains on Intel

Advanced Micro Devices reported second-quarter earnings today that beat analysts’ estimates as it capitalizes on a rare lead in performance over archrival Intel. AMD posted a 26% gain in revenue for the quarter that ended June 30, compared to the same quarter a year ago.

Santa Clara, California-based AMD reported non-GAAP net income of 18 cents a share on revenue of $1.93 billion. The company is in the midst of a historic upswing as it exploits its advantages over Intel, including a well-defined Zen 2 processor architecture and a cost-efficient 7-nanometer manufacturing process with its partners. In after-hours trading, AMD’s stock price rose 7% to $72.34 a share.

AMD is also challenging rival Nvidia with a new set of mainstream graphics chips. And AMD promises it will continue to move quickly when it comes to designing its next-generation processor architecture, dubbed Zen 3. On Tuesday, the company attributed the positive earnings results to higher enterprise, embedded, and semi-custom revenue. (The latter represents chips for game consoles.) Sales have stayed strong in the pandemic as people working from home upgrade to new computers.

Analysts estimated AMD would report non-GAAP earnings of 16 cents a share on revenues of $1.86 billion. In the year-ago quarter, AMD reported adjusted earnings of 8 cents a share and sales of $1.53 billion. In the third quarter, revenues are expected to be $2.31 billion. For the third calendar quarter, AMD said it now expects revenue of $2.55 billion, plus or minus $100 million, driven by Ryzen, Epyc, and semi-custom chip sales.

Intel announced on July 23 that it had a good quarter, but it also said it had run into delays with its 7-nanometer manufacturing (Intel measures this differently from AMD), which is a disaster coming off similar delays with its deployment of 10-nanometer production. Intel spends tens of billions on its chip factories and makes its own chips. AMD designs its chips and then farms out the manufacturing to contract chip manufacturers like TSMC, which has not had the same kinds of troubles as Intel.

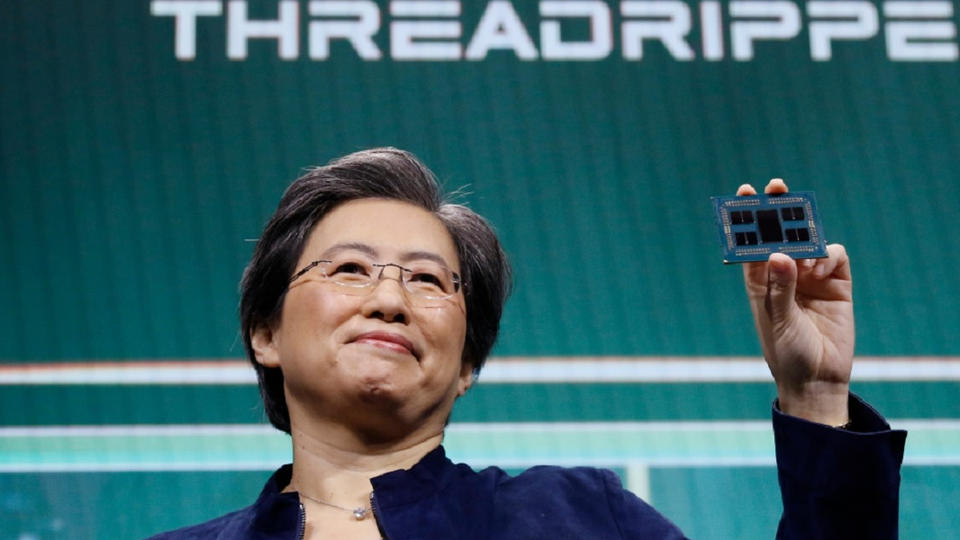

“We delivered strong second-quarter results, led by record notebook and server processor sales, as Ryzen [PC chip] and Epyc [server chip] revenue more than doubled from a year ago,” said AMD CEO Lisa Su in a statement. “Despite some macroeconomic uncertainty, we are raising our full-year revenue outlook as we enter our next phase of growth, driven by the acceleration of our business in multiple markets.”

In an analyst call, Su said the company has grown market share in processors for 11 quarters in a row. She noted that there are 54 Ryzen Mobile laptops in the market and HP and Lenovo are launching more soon. She also said benchmarks show Ryzen Mobile chips beating Intel’s best in both performance and battery life.

“We passed a significant milestone in the quarter, as we achieved our double-digit server processor unit share goal, based on broad adoption across cloud enterprise and HPC customers,” Su said.

Intel’s new delay with its 7-nanometer manufacturing could give AMD another opportunity to gain market share. But the competition will be stiff, as Intel is still much larger than AMD and has contingency plans to make high-quality chips with its current 10-nanometer manufacturing process.

The company has deals with Microsoft on the Xbox Series X and Sony on the PlayStation 5 — with both consoles launching in the fall. AMD has a big sales cycle beginning as it starts delivering chips for the video game consoles. That money is already starting to come in as AMD ships chips to the companies ahead of launch.

AMD said the average selling price for its client CPUs was up compared to a year ago and down from the previous quarter, due to a higher percentage of Ryzen mobile processor sales. GPU average selling prices were down from a year ago and the previous quarter due to lower channel sales. Datacenter GPU declined year-over-year.

AMD expects gross profit margins to be 44% in the third quarter, thanks to Ryzen and Epyc processor sales. Overall, AMD expects revenue to grow 32% in 2020, while non-GAAP gross profit margins are expected to be 45%.

“AMD had a solid quarter, revenue- and profit-wise, with 26% growth and a 3% gross margin improvement. Like we saw in Q1, AMD set some revenue records in Q2,” said Moor Insights & Strategy analyst Patrick Moorhead in an email to VentureBeat. “As in Q1, AMD set records in (client computing group) CCG with the highest client processor revenue in 12 years, driving 45% growth and doubling Ryzen notebook revenue. In fact, this was the highest notebook revenues ever. I believe both these records were driven by the company’s increased competitiveness in notebooks, particularly with its Ryzen Mobile 4000 platform, which, in Q2, was selling for back to school designs.”

In servers and consoles, Moorhead said, “While overall segment revenue was down, I was pleased to see that Epyc server CPUs set records as [Epyc] doubled revenue year-on-year. I attribute most of this Epyc growth to cloud service, SaaS, and HPC players embracing the platform more and more. It likely took share in the non-internet-of-things server space.”

In the analyst call, Su said AMD has begun production of its next-generation console system-on-chip products, which combine a processor and graphics in the same chip. In response to a question on the call, Su said the third quarter would be strong for console chip sales and the fourth quarter would be lower, given the usual launch dynamics.

AMD currently has 11,400 employees.