Real estate firm scoops up San Jose site where village was proposed

Real estate investors with ties to the Bay Area and Chicago have bought a big north San Jose site where a developer had once proposed a mixed-use neighborhood next to a busy light rail line.

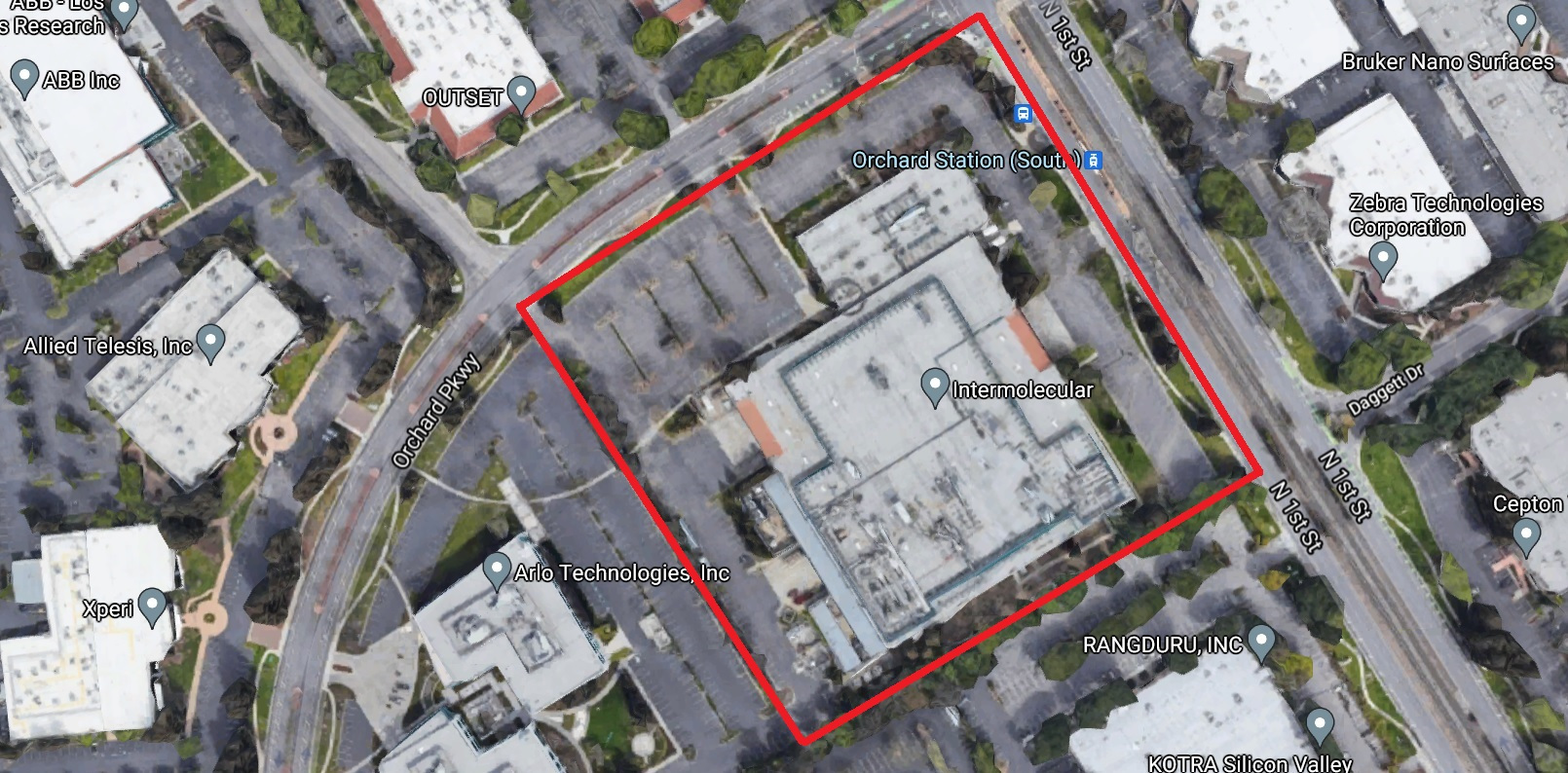

The investors paid $28.9 million for a building and parking lot at 3011 N. First St. in San Jose, according to documents that were filed on June 4 with the Santa Clara County Recorder’s Office.

The buyer was an affiliate headed up by two real estate investment and development firms, according to county and state public records: Chicago-based Blue Vista Capital Management and San Francisco-based Cannae Partners.

Palo Alto-based Sand Hill Property Co. was the seller, the county records show. In 2015, Sand Hill affiliate SHP-CUTE paid $31 million for the 9.3-acre property.

In 2018, Sand Hill Property floated very preliminary plans for the development on the site of a huge mixed-use village of offices, homes and retail spaces.

City records didn’t disclose how far the proposal has proceeded through the San Jose planning process.

Sand Hill Property had requested a preliminary city review of a proposal for 505,000 square feet of offices, 800 residential units and 13,000 square feet of retail.

It’s possible that the recently completed property purchase was undertaken on behalf of major buyers that invest in real estate worldwide.

Blue Vista Capital often partners on investments with big players such as “pension funds, endowments, foundations, insurance companies, wealth managers and corporations,” according to the Blue Vista website.

Cannae prefers to focus on properties in the Bay Area.

What wasn’t immediately clear was whether some sort of redevelopment of the site would be pursued by the new owners.

The location is certainly a choice spot in San Jose since it’s at the corner of North First Street and Orchard Parkway and is next to the Orchard Station that is part of one of the business stretches of the region’s light rail system.

At present, Intermolecular, an electronics manufacturing company, leases a 146,200-square-foot office and research building on the property.

Intermolecular’s lease has several years left to run, so the property could be an ongoing producer of rental income for the new owners.

As part of the just-completed property purchase, the buyers agreed to assume a $21 million mortgage that had been previously for the property, according to the public documents.